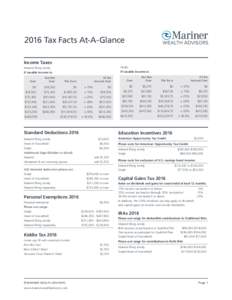

11 | Add to Reading ListSource URL: www.marinerwealthadvisors.comLanguage: English - Date: 2016-03-06 21:33:12

|

|---|

12 | Add to Reading ListSource URL: taxfoundation.orgLanguage: English - Date: 2016-02-05 11:44:55

|

|---|

13![Microsoft PowerPoint - FedState Fall 2015.pptx [Read-Only] Microsoft PowerPoint - FedState Fall 2015.pptx [Read-Only]](https://www.pdfsearch.io/img/9298454ccca42981b1a9f08c0ad660de.jpg) | Add to Reading ListSource URL: www.revenue.nebraska.govLanguage: English - Date: 2015-10-09 15:36:14

|

|---|

14 | Add to Reading ListSource URL: d2kje4aw0lzm6i.cloudfront.netLanguage: English - Date: 2015-09-29 16:25:51

|

|---|

15 | Add to Reading ListSource URL: revenue.ky.govLanguage: English - Date: 2016-01-09 06:16:39

|

|---|

16 | Add to Reading ListSource URL: www.benefitplans.baml.comLanguage: English - Date: 2015-07-08 16:20:21

|

|---|

17 | Add to Reading ListSource URL: www.woodllp.comLanguage: English - Date: 2014-06-11 16:30:33

|

|---|

18 | Add to Reading ListSource URL: www.coopernorman.comLanguage: English - Date: 2014-11-04 17:38:00

|

|---|

19 | Add to Reading ListSource URL: www.brccpa.comLanguage: English - Date: 2014-09-14 18:12:43

|

|---|

20 | Add to Reading ListSource URL: ruboyianes.comLanguage: English - Date: 2012-02-04 11:26:48

|

|---|